Printable 1099 Forms For Independent Contractors: Everything You Need to Know

Are you an independent contractor looking for printable 1099 forms to file your taxes accurately? Look no further! In this comprehensive guide, we will cover everything you need to know about printable 1099 forms for independent contractors, including how to download and save them for your records.

Knowledge

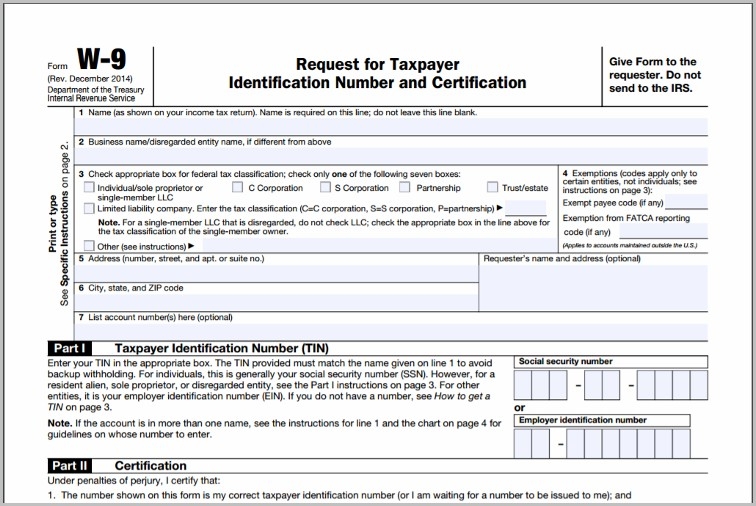

First and foremost, it is essential to understand what a 1099 form is and why it is crucial for independent contractors. A 1099 form is used to report income other than wages, salaries, and tips. As an independent contractor, you are considered self-employed, and it is your responsibility to report your earnings to the IRS using the 1099 form.

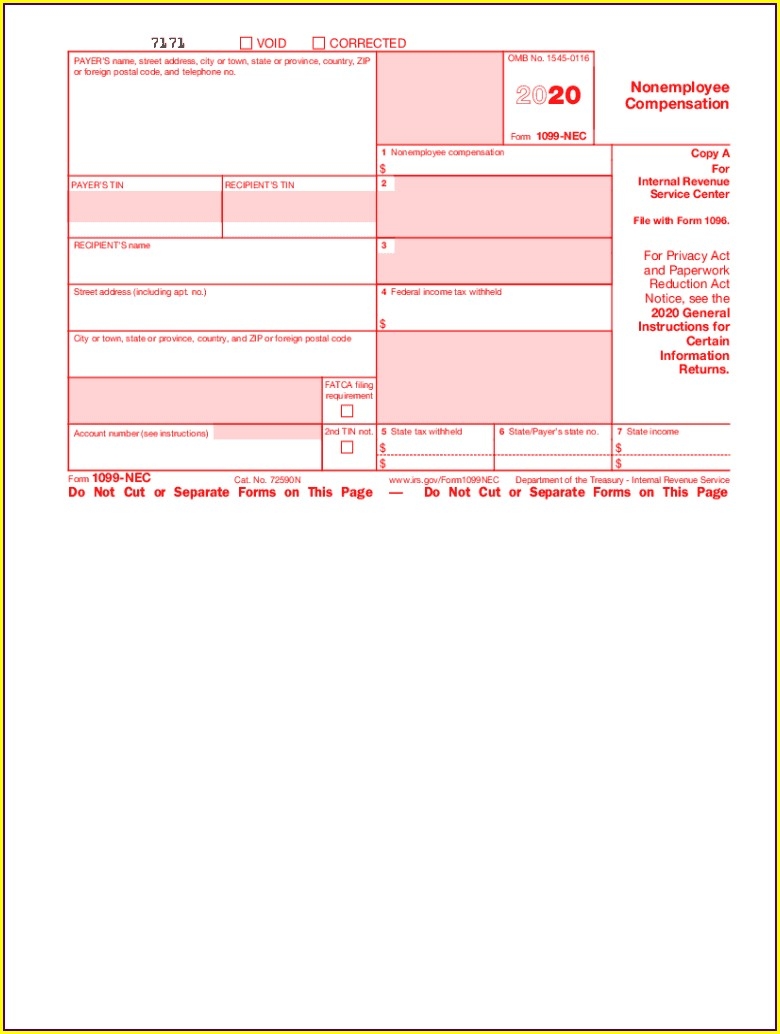

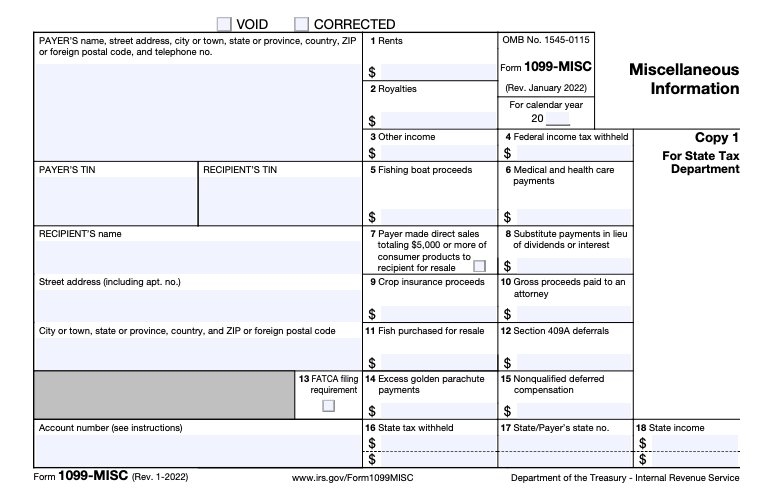

There are several types of 1099 forms, but the most common one for independent contractors is the 1099-MISC. This form includes information about the income you have earned from clients or companies throughout the tax year. It is essential to accurately report this income to avoid any penalties or audits from the IRS.

When it comes to printable 1099 forms, you have the option to download them directly from the IRS website. These forms are available in PDF format, making it easy to fill them out electronically or print them for manual completion. It is crucial to ensure that you are using the most up-to-date version of the form to avoid any discrepancies in your tax filing.

One thing to keep in mind when filling out your 1099 form is to report all income earned as an independent contractor, including any bonuses, commissions, or fees. Accuracy is key when it comes to tax reporting, so make sure to double-check your figures before submitting the form to the IRS.

How to download and save it

To download and save a printable 1099 form for independent contractors, follow these simple steps:

It is recommended to save a copy of the completed form for your records and to provide a copy to your clients or companies as required by the IRS. Keeping accurate records of your income and expenses is essential for proper tax reporting as an independent contractor.

Conclusion

In conclusion, printable 1099 forms for independent contractors are a vital tool for accurate tax reporting. By understanding the importance of these forms and how to download and save them, you can ensure that your tax filing is done correctly and efficiently.

Independent contractors, freelancers, and self-employed individuals can benefit greatly from using printable 1099 forms to report their income and comply with IRS regulations. By following the guidelines outlined in this guide, you can streamline the tax filing process and avoid any potential issues with the IRS.