Form 2290 Printable: Your Ultimate Guide to IRS Heavy Highway Vehicle Use Tax

Are you a truck owner or operator looking to file your heavy highway vehicle use tax return with ease? Look no further than the Form 2290 Printable. In this article, we will delve into everything you need to know about this essential IRS form, how to download and save it, and why it matters in the world of trucking. Let’s get started!

Knowledge

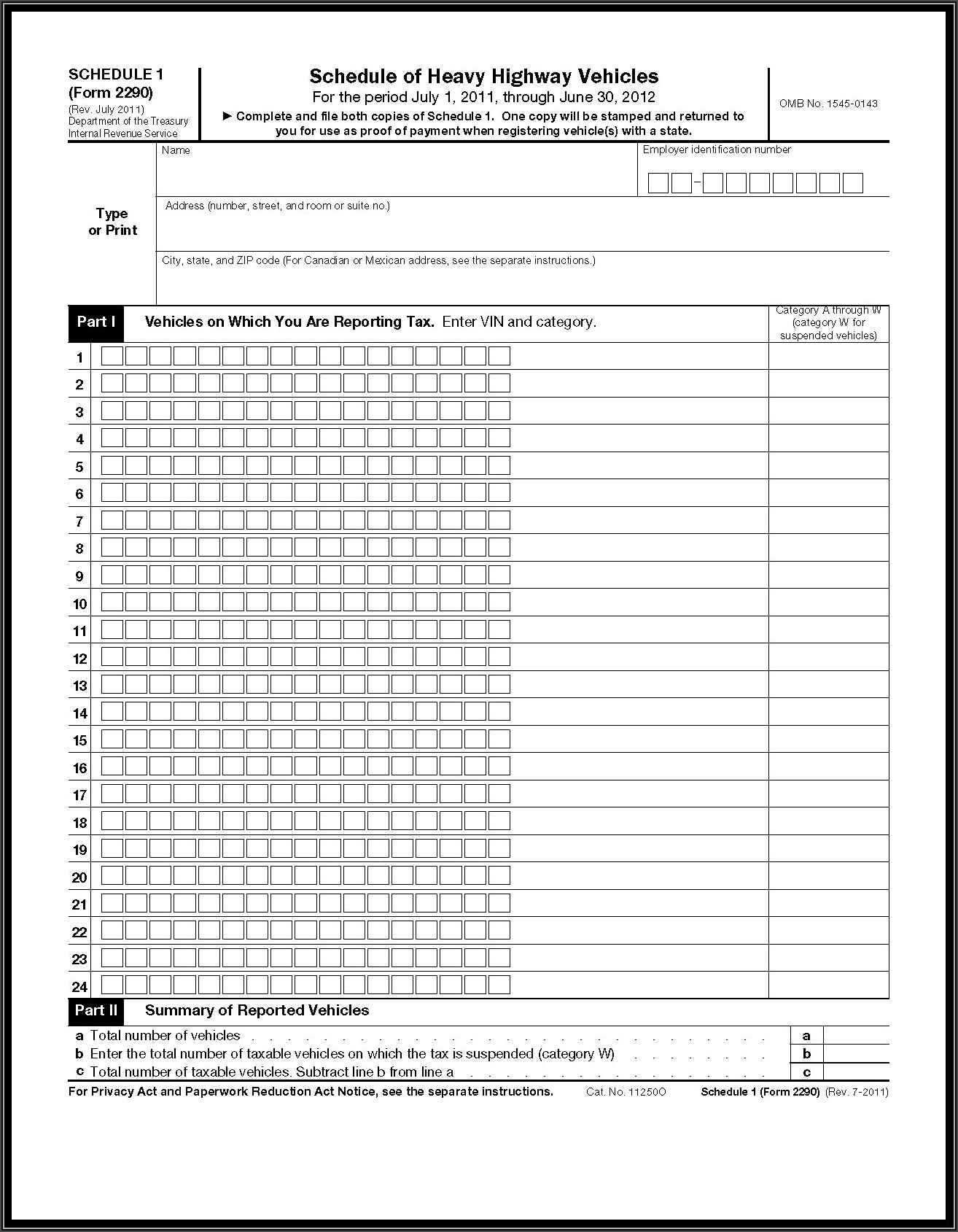

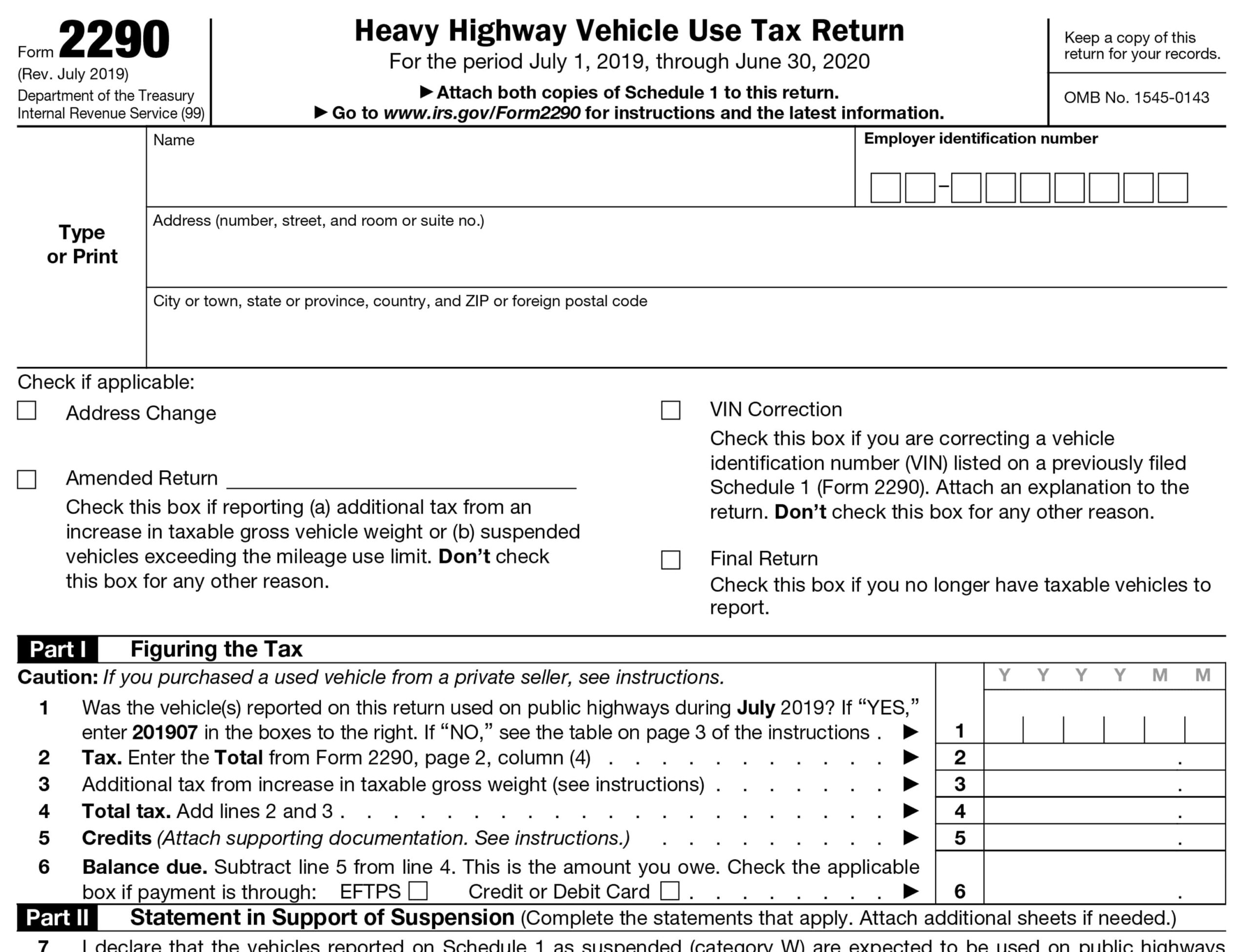

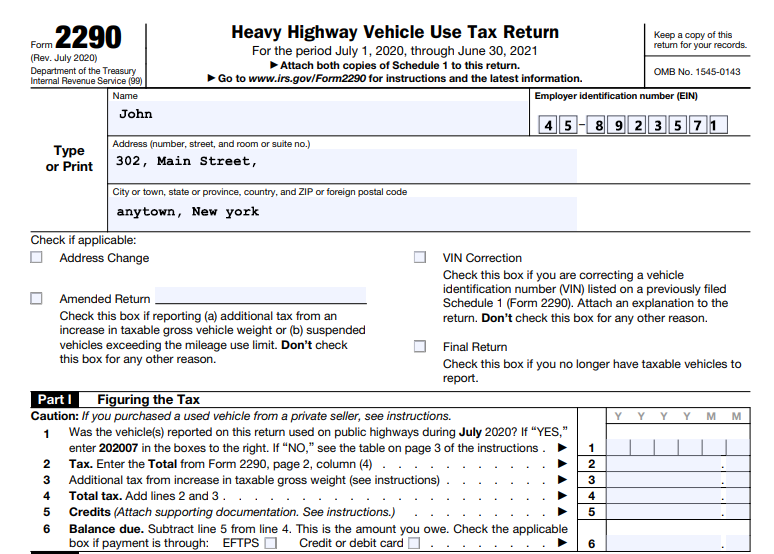

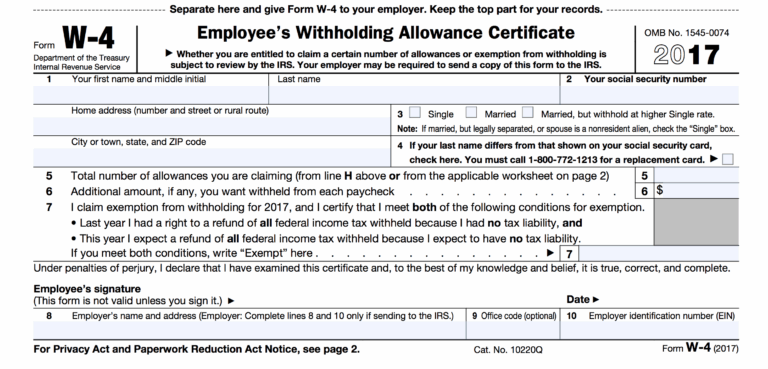

Form 2290, also known as the Heavy Highway Vehicle Use Tax Return, is an IRS form that must be filed by owners and operators of heavy vehicles with a gross weight of 55,000 pounds or more. This form is used to report and pay the federal excise tax on heavy highway vehicles that are registered in your name. The tax rates vary depending on the weight of your vehicle and how many miles it is expected to travel during the tax period.

When it comes to Form 2290 Printable, it allows you to fill out the form electronically and then print it for your records. This makes the process of filing your heavy highway vehicle use tax return much more convenient and efficient. You can easily access the printable form on the IRS website or through authorized e-file providers.

Before you start filling out Form 2290 Printable, make sure you have all the necessary information on hand. This includes your Employer Identification Number (EIN), VIN (Vehicle Identification Number), and the taxable gross weight of your vehicle. You will also need to provide information about the first month the vehicle was used on public highways during the tax period.

It’s important to note that Form 2290 must be filed annually, with the deadline falling on August 31st of each year. Failure to file or pay the heavy highway vehicle use tax can result in penalties and interest, so it’s crucial to stay on top of your tax obligations as a truck owner or operator.

How to download and save it

Downloading and saving Form 2290 Printable is a simple process that can be done in just a few steps. First, visit the IRS website and navigate to the Forms & Instructions section. Look for Form 2290 and click on the link to download the printable version. Once the form is downloaded, you can open it using a PDF reader and fill it out electronically.

After filling out all the required fields on Form 2290 Printable, you can save the form to your computer for future reference. Make sure to keep a copy of the completed form for your records and submit it to the IRS by the deadline to avoid any penalties.

Conclusion

In conclusion, Form 2290 Printable is a valuable tool for truck owners and operators to file their heavy highway vehicle use tax return with ease. By understanding the ins and outs of this IRS form, you can ensure compliance with tax regulations and avoid unnecessary penalties. The target audience for Form 2290 Printable includes trucking companies, owner-operators, and fleet managers who need to report and pay the federal excise tax on heavy vehicles.

Overall, Form 2290 Printable plays a crucial role in the world of trucking by simplifying the tax filing process and ensuring that heavy highway vehicles contribute their fair share to the upkeep of public highways. As the trucking industry continues to evolve, staying informed about tax obligations and utilizing tools like Form 2290 Printable will be key to success in this competitive market.