Check Register Printable: A Comprehensive Guide to Managing Your Finances

In today’s fast-paced digital world, it can be easy to lose track of your finances. Printable check registers offer a simple yet effective solution, providing a tangible way to record and manage your financial transactions.

Whether you’re a seasoned financial pro or just starting out, a printable check register can help you gain control of your spending, reduce errors, and improve your overall financial health.

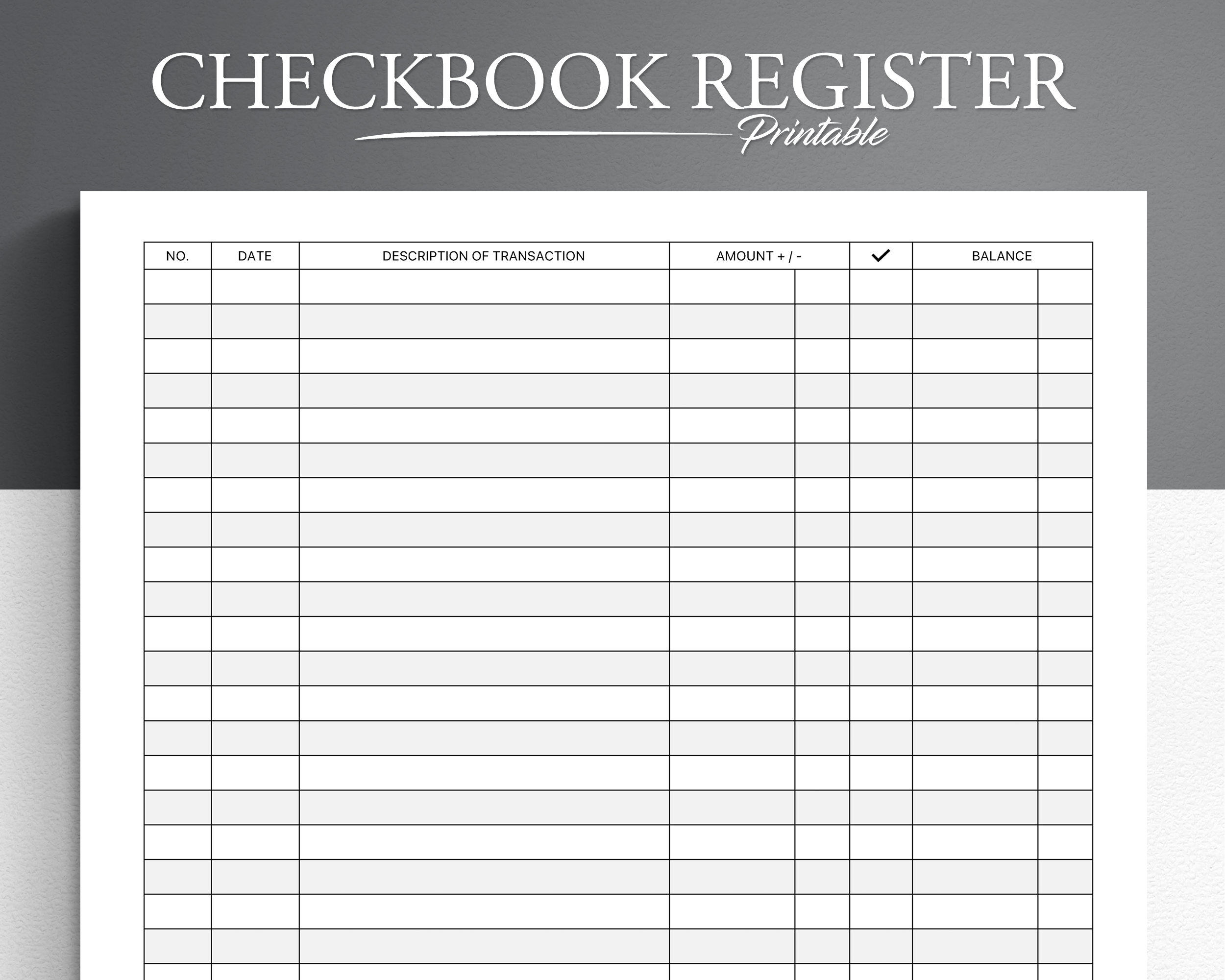

Printable Check Register Features

A printable check register is a tool that helps you track your checkbook transactions and manage your finances. It typically includes a variety of features to make it easy to keep track of your spending and income.

Here are some of the most common features found in printable check registers:

Customizable Fields

- Allows you to add custom fields to track specific information, such as the purpose of the transaction or the payee’s contact information.

Multiple Account Support

- Enables you to track multiple checking and savings accounts in one register.

Transaction Tracking

- Records each check you write, including the date, check number, payee, amount, and category.

- Provides a running balance of your account.

Reconciliation Tools

- Helps you reconcile your check register with your bank statement.

- Identifies any discrepancies between the two.

Benefits of Using a Printable Check Register

Grab a pen and paper, mate, ’cause printable check registers are the bomb for keepin’ track of your dosh. They’re like a trusty sidekick that’ll help you stay on top of your finances, unlike those dodgy digital methods.

Here’s the lowdown on why you should ditch the apps and go old-school:

Financial Clarity

- You can see every penny comin’ and goin’, no more guessin’ games. It’s like havin’ a crystal ball for your bank account.

- No more nasty surprises when you check your balance. You’ll know exactly what you’ve got and what you owe.

Spending Control

- Track every quid you spend, so you can see where your money’s goin’ like a boss. No more wonderin’ where your hard-earned cash disappeared.

- Set budgets and stick to ’em like glue. It’s like havin’ a personal trainer for your finances, keepin’ you in check.

Reduced Errors

- Say goodbye to dodgy calculations and human error. With a printable check register, every transaction is right there in front of you, clear as day.

- No more stressin’ over mistakes. You can double-check and triple-check your figures until you’re satisfied.

How to Choose the Right Printable Check Register

Selecting the ideal printable check register involves considering your specific requirements. Factors to ponder include the quantity of accounts you possess, the frequency of your transactions, and the functionalities you seek.

Evaluating Key Specifications

When comparing various check registers, scrutinize their specifications to ascertain which aligns best with your needs. A comprehensive comparison table can assist in this evaluation process. Consider the following aspects:

– Number of Accounts Supported: Determine the number of accounts you need to track and select a register that accommodates them.

– Transaction Volume: Estimate the average number of transactions you make per month and choose a register with sufficient space to record them.

– Features: Consider essential features such as running balance calculation, check reconciliation, and customizable categories to enhance your financial management.

– Size and Portability: Choose a register size that suits your needs and portability requirements, whether you prefer a compact size for on-the-go use or a larger size for more detailed record-keeping.

Step-by-Step Guide to Using a Printable Check Register

To get the most out of your printable check register, follow these steps:

Setting Up the Register

– Choose a template that suits your needs.

– Fill in your personal and bank details.

– Start with a zero balance.

Recording Transactions

– Enter each check written, including the check number, date, payee, amount, and purpose.

– Record deposits as positive amounts.

– Note any ATM withdrawals or other debits.

Reconciling Accounts

– Compare your register balance to your bank statement.

– Identify any discrepancies and correct them.

– Make adjustments for outstanding checks or deposits.

Additional Tips

– Keep your register up-to-date to avoid errors.

– Use a different colored pen for different types of transactions.

– Consider using a check register app for convenience.

Tips for Maintaining an Accurate Printable Check Register

Keeping a printable check register accurate and up-to-date is crucial for managing your finances effectively. Here are some best practices to help you maintain an accurate register:

Regular Updates

- Update your check register regularly, preferably daily or weekly.

- Record all transactions, including deposits, withdrawals, and checks written.

- Don’t leave any blank spaces or gaps in the register.

Accurate Data Entry

- Enter the correct amount for each transaction.

- Use a calculator to avoid errors.

- Double-check your entries before finalizing.

Clear and Organized Records

- Use a clear and consistent handwriting.

- Avoid using abbreviations or shorthand.

- Keep your register organized by using different colors for different types of transactions.

Regular Reconciliation

- Reconcile your check register with your bank statement regularly, at least once a month.

- Identify and correct any discrepancies.

- Regular reconciliation helps prevent errors and ensures accuracy.

Additional Tips

- Use a separate check register for each checking account.

- Keep your check register in a safe and secure location.

- Make backups of your check register regularly.

By following these tips, you can maintain an accurate and up-to-date printable check register, which will help you manage your finances more effectively.

Printable Check Register Templates

To suit various needs and preferences, our comprehensive collection of printable check register templates covers personal use, small businesses, and specialized industries.

Explore our extensive gallery below, showcasing an array of templates tailored to your specific requirements.

Template Table

The following table provides a concise overview of the printable check register templates available for download:

| Template Name | Purpose | Features |

|---|---|---|

| Personal Check Register | Individual financial tracking | Basic columns for recording transactions, running balance calculation |

| Small Business Check Register | Business financial management | Additional columns for tracking expenses, income, and tax information |

| Industry-Specific Check Register (e.g., Healthcare, Non-profit) | Specialized financial tracking | Customized columns tailored to specific industry requirements |

FAQ Corner

What is a printable check register?

A printable check register is a physical document that you can use to record and track your financial transactions. It typically includes columns for recording the date, check number, payee, amount, and balance.

What are the benefits of using a printable check register?

There are many benefits to using a printable check register, including improved financial visibility, better control over spending, and reduced errors.

How do I choose the right printable check register?

When choosing a printable check register, you should consider factors such as the number of accounts you have, the volume of transactions you make, and the features that are important to you.

How do I use a printable check register?

Using a printable check register is simple. Just record your transactions as they occur, and be sure to reconcile your register regularly.

What are some tips for maintaining an accurate printable check register?

To maintain an accurate printable check register, be sure to record your transactions promptly, keep your register organized, and reconcile your register regularly.