Everything You Need to Know About W4 Form 2026 Printable

Are you looking for the W4 Form 2026 Printable and want to understand how to download and save it for your records? Look no further as this article will provide you with all the essential information you need. The W4 Form 2026 Printable is a crucial document that every employee must fill out to ensure accurate tax withholding from their paychecks. Let’s dive into the details and make sure you have all the necessary knowledge to handle this form with ease.

Knowledge

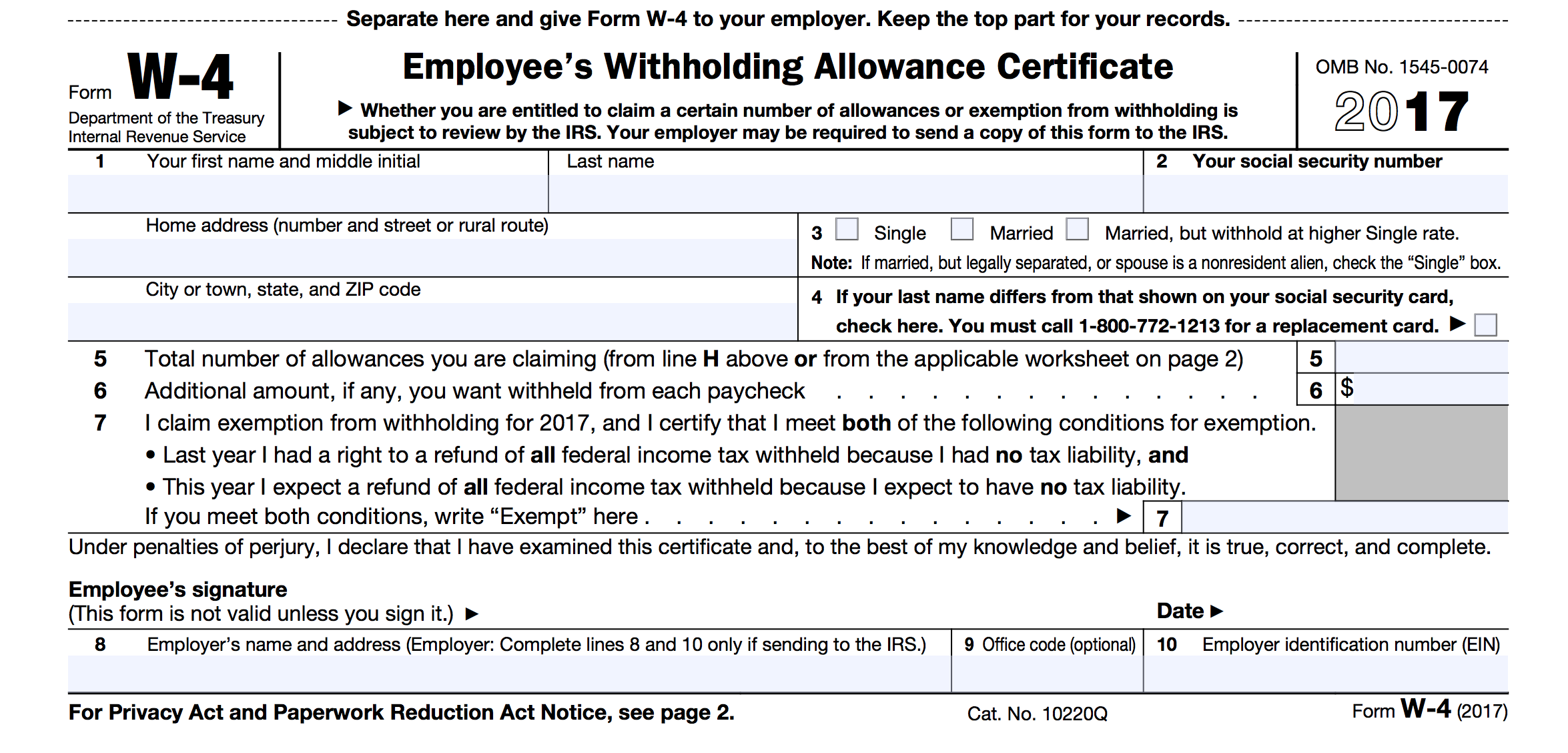

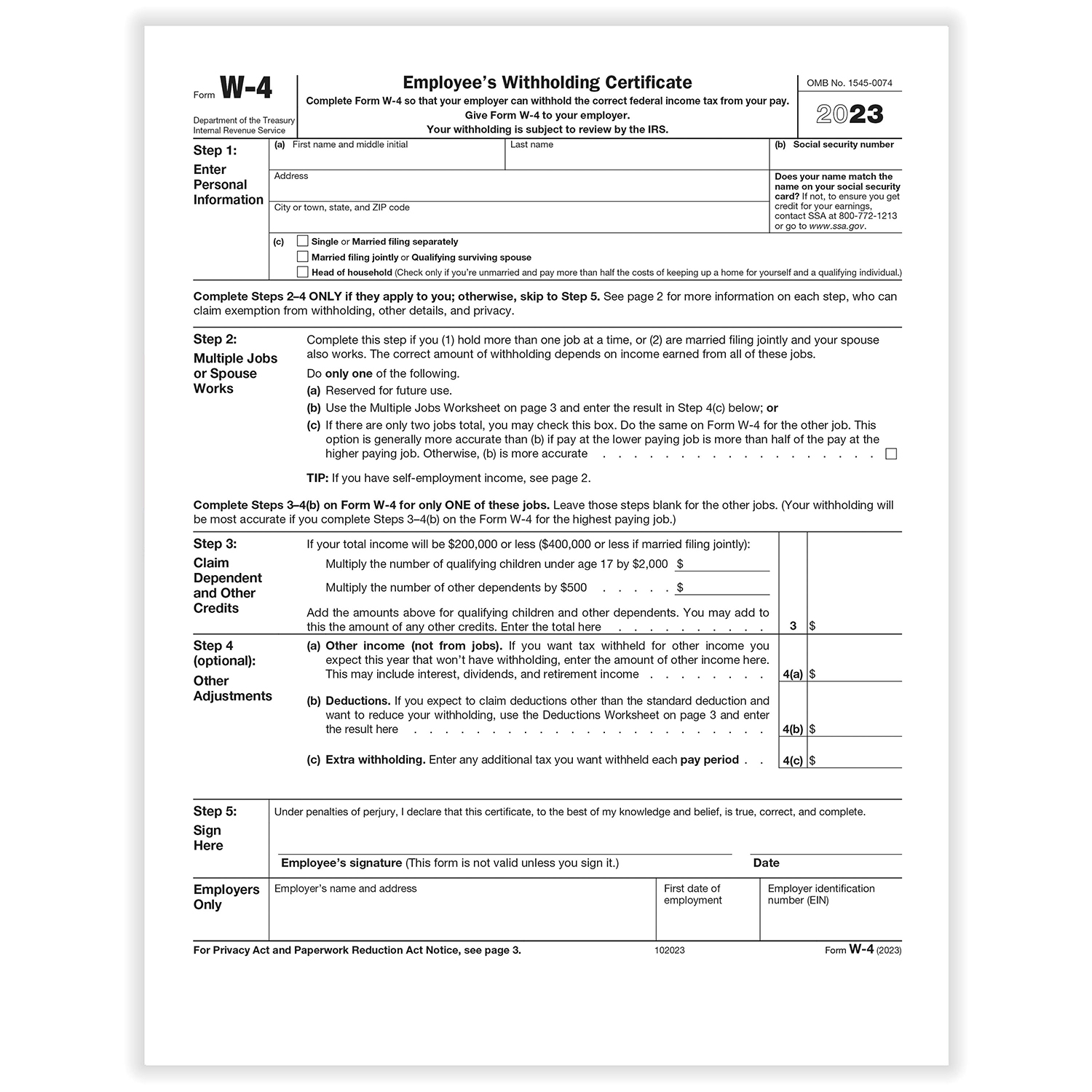

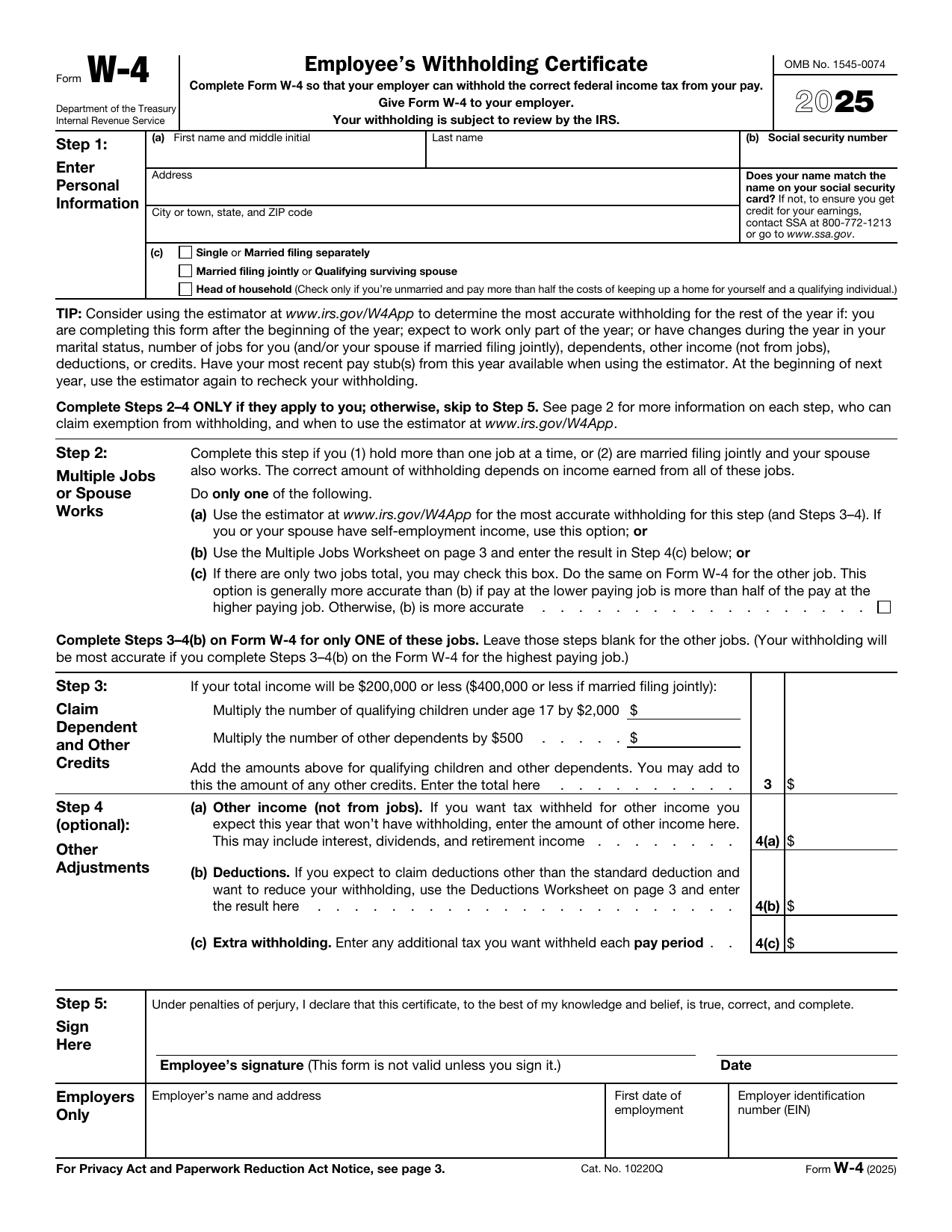

The W4 Form 2026 Printable is an updated version of the standard W-4 form that employees use to inform their employers how much tax to withhold from their paychecks. This form is essential for both employees and employers to ensure accurate tax calculations and withholdings throughout the year.

When filling out the W4 Form 2026 Printable, employees need to provide information such as their name, address, filing status, and the number of allowances they wish to claim. It is crucial to fill out this form accurately to avoid under or over-withholding taxes, which can result in unexpected tax bills or refunds at the end of the year.

Employees can use the W4 Form 2026 Printable to update their withholding information whenever their financial or personal situation changes. For example, if you get married, have a child, or take on a second job, you may need to adjust your withholding allowances to reflect these changes accurately.

Employers use the information provided on the W4 Form 2026 Printable to calculate how much federal income tax to withhold from each employee’s paycheck. By following the instructions on the form and using the IRS withholding calculator, employers can ensure accurate tax withholdings for all employees.

How to download and save it

To download the W4 Form 2026 Printable, you can visit the official IRS website and search for the form using its form number. Once you locate the form, you can download it as a PDF file and save it to your computer or device for easy access.

Make sure to fill out the form accurately and completely before submitting it to your employer. Keep a copy for your records and refer to it whenever you need to make changes to your withholding information.

Conclusion

In conclusion, the W4 Form 2026 Printable is a vital document that ensures accurate tax withholdings for employees and employers. By understanding how to fill out this form correctly and update it as needed, you can avoid any surprises come tax time and ensure that your financial affairs are in order.

Overall, the W4 Form 2026 Printable is a simple yet essential tool that every employee should be familiar with. Make sure to keep your withholding information up to date and consult with a tax professional if you have any questions or concerns about your tax withholdings.