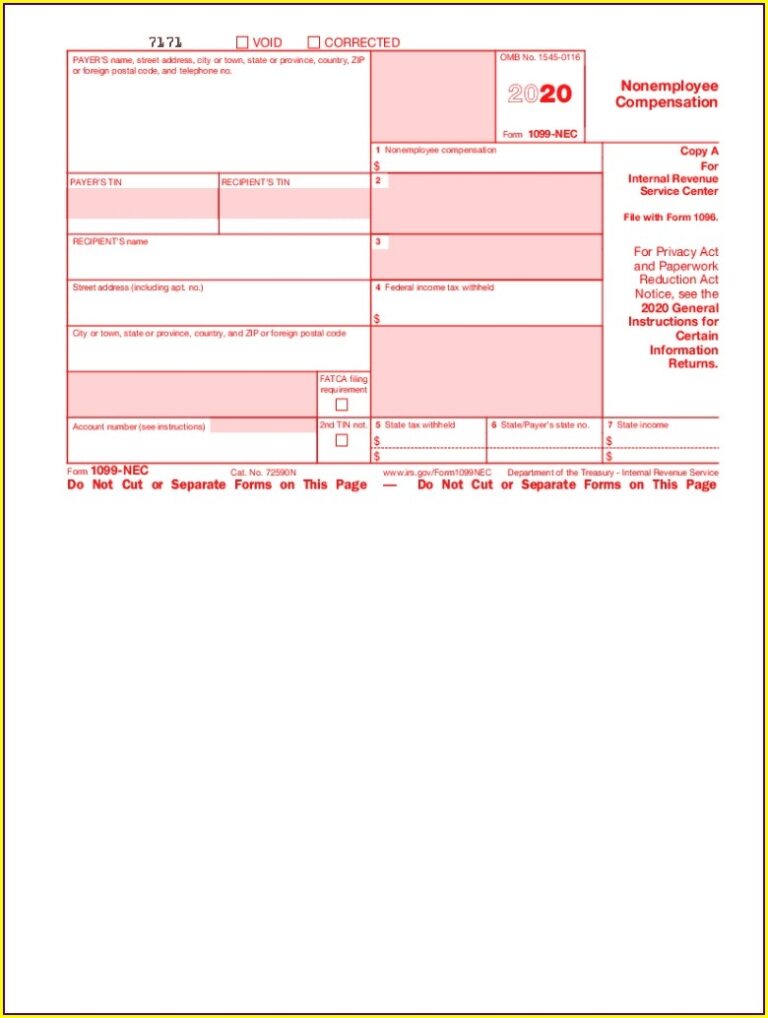

1099 Nec Form 2026 Printable: Your Comprehensive Guide

Are you in need of the 1099 Nec Form 2026 Printable but unsure of where to start? Look no further! In this article, we will delve into everything you need to know about this form, how to download and save it, and why it is essential for your records. Let’s get started!

Knowledge

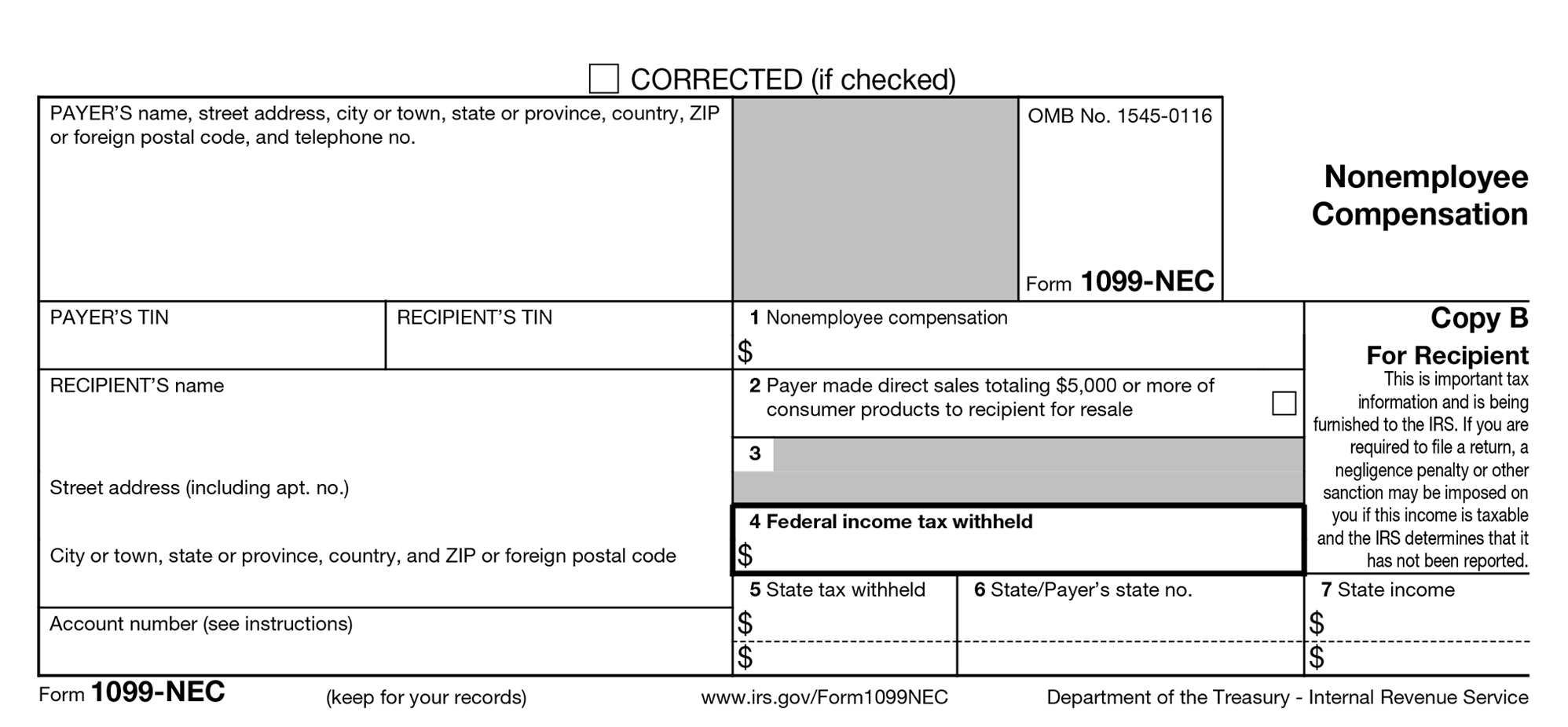

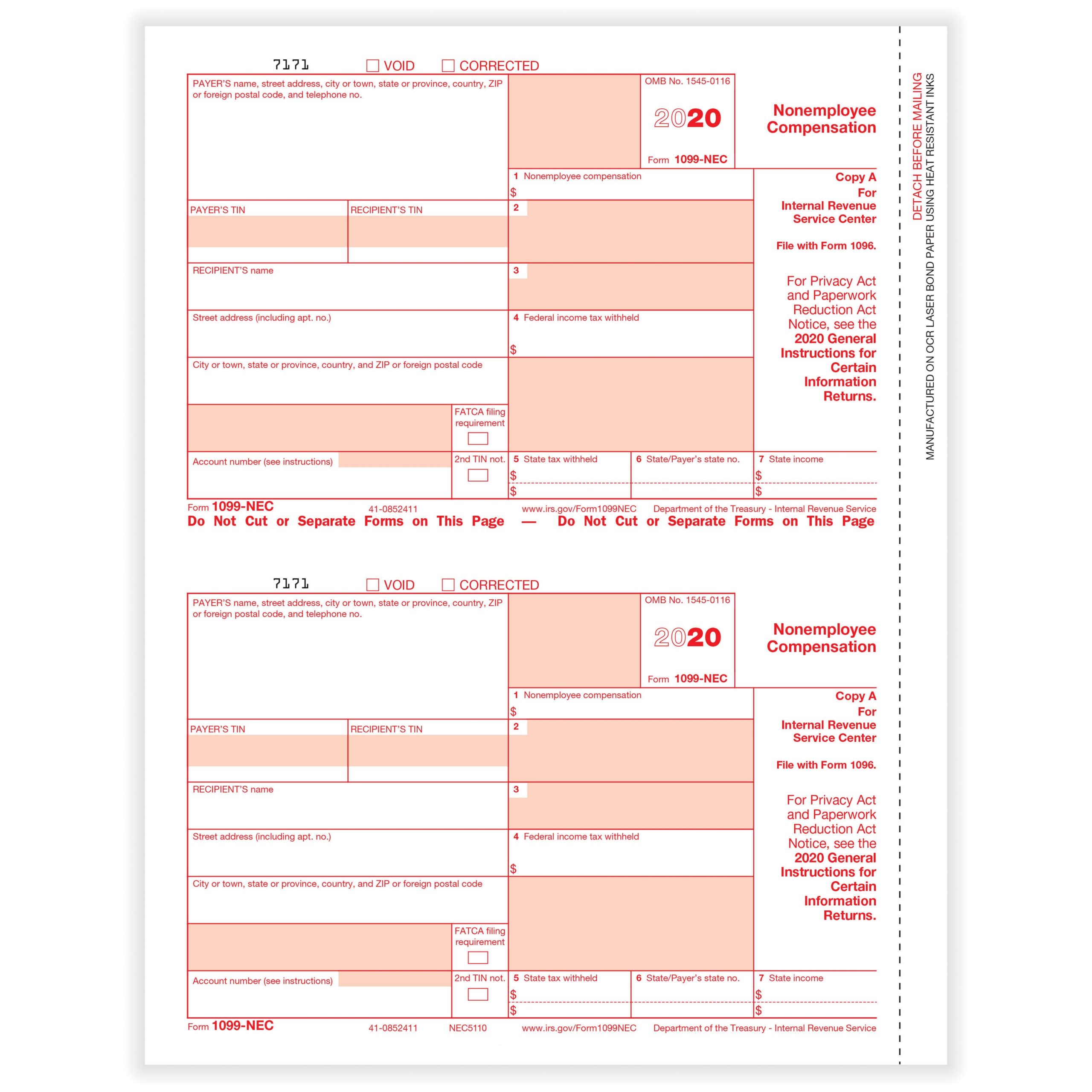

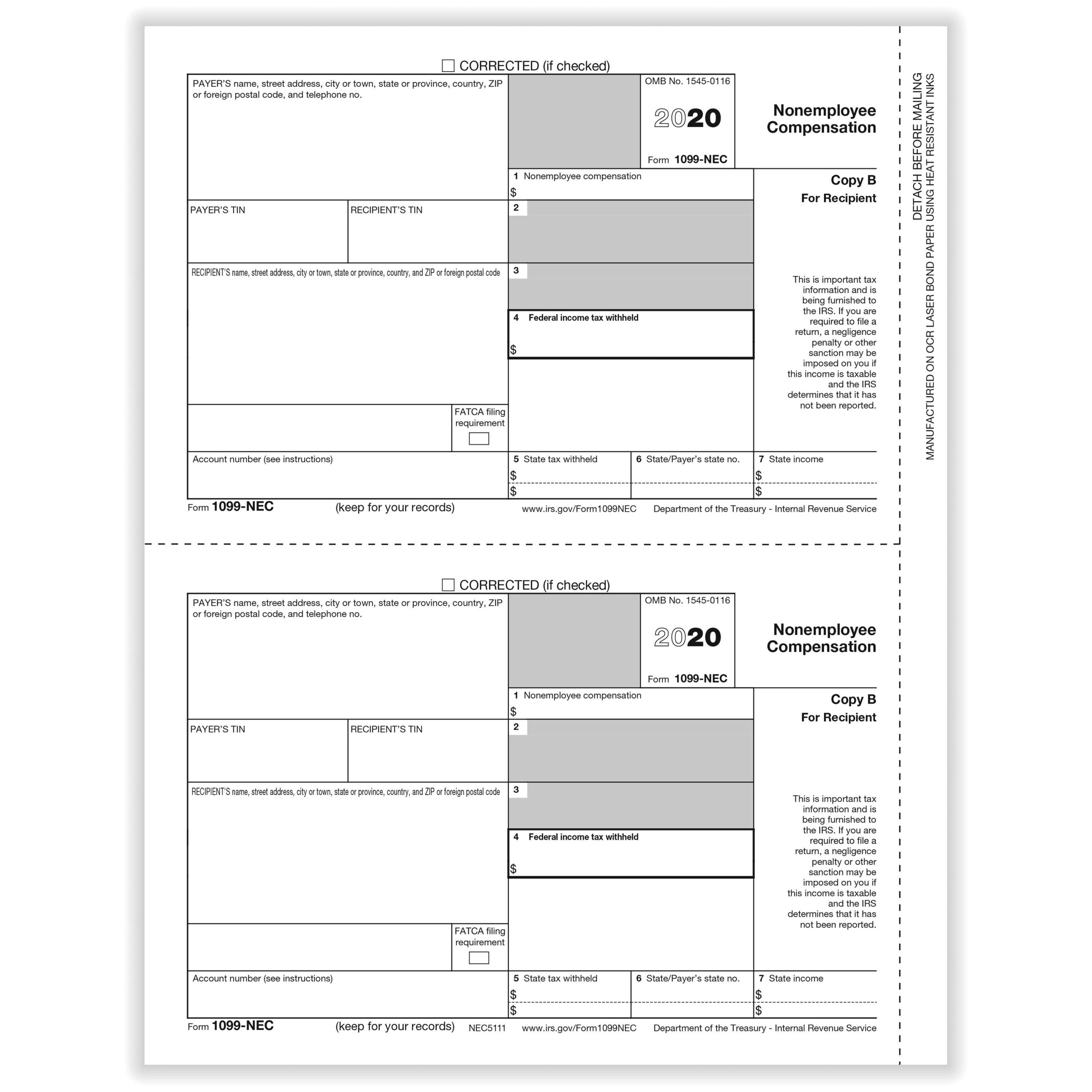

The 1099 Nec Form 2026 Printable is a crucial document for any individual or business that has paid non-employee compensation amounting to $600 or more in a tax year. This form is used to report this income to the IRS and the recipient. It is important to ensure that this form is filled out accurately and submitted on time to avoid any penalties or fines.

When filling out the 1099 Nec Form 2026 Printable, you will need to provide details such as the recipient’s name, address, social security number or tax identification number, and the total amount of non-employee compensation paid. It is essential to double-check all information before submitting the form to ensure accuracy.

Understanding the guidelines and requirements for the 1099 Nec Form 2026 Printable is crucial to ensure compliance with IRS regulations. Failure to report non-employee compensation accurately can result in penalties and unwanted scrutiny from tax authorities. Therefore, it is essential to stay informed and up-to-date with the latest tax regulations to avoid any potential issues.

How to download and save it

Downloading and saving the 1099 Nec Form 2026 Printable is a simple process. You can easily access the form on the IRS website or through reputable tax preparation software. Once you have downloaded the form, you can fill it out electronically or print it out and complete it by hand.

It is important to save a copy of the completed form for your records and submit the necessary copies to the IRS and the recipient by the specified deadline. Keeping organized records of all tax-related documents, including the 1099 Nec Form 2026 Printable, will help ensure smooth tax filing processes and compliance with regulations.

Conclusion

In conclusion, the 1099 Nec Form 2026 Printable is a vital document for reporting non-employee compensation to the IRS and the recipient. It is essential to understand the requirements and guidelines for this form to avoid any potential issues or penalties. This form is particularly important for businesses and individuals who regularly pay non-employee compensation.

Overall, the 1099 Nec Form 2026 Printable is a valuable tool for ensuring compliance with tax regulations and accurately reporting income. By staying informed and organized, you can streamline the tax filing process and avoid any unnecessary stress or complications.