Printable Check Register For Checkbook: A Comprehensive Guide to Manage Your Finances Effectively

Managing checkbook transactions can be a daunting task, especially when you’re dealing with multiple accounts and a steady flow of financial transactions. Printable check registers offer a simple yet powerful solution to this challenge, providing a clear and organized way to track your income and expenses.

In this guide, we’ll delve into the world of printable check registers, exploring their features, benefits, and best practices. Whether you’re new to checkbook management or looking to optimize your current system, this comprehensive overview will equip you with the knowledge and tools you need to stay on top of your finances.

Additional Considerations

It’s important to keep your check register and the financial information it contains safe. Consider these security measures:

- Keep your check register in a secure location, away from prying eyes.

- Shred any old or unused check registers to prevent identity theft.

- Use a password-protected app or software to store your check register digitally.

Integrating your check register with other financial management tools can streamline your money management. Here are some suggestions:

- Use a budgeting app that allows you to import your check register data.

- Link your check register to your online banking account for automatic updates.

- Consider using a financial planning software that includes a check register feature.

If you need a printable check register, you can find templates online or purchase them from stationery stores. Some popular options include:

- Microsoft Office templates

- Google Sheets templates

- Avery check registers

FAQ Corner

What is the purpose of a printable check register?

A printable check register is a document that allows you to manually record and track your checkbook transactions. It provides a structured and organized way to keep a record of your income, expenses, and account balance.

What are the benefits of using a printable check register?

Using a printable check register offers several benefits, including improved financial accuracy, better expense tracking, reduced risk of overdrafts, and simplified reconciliation with bank statements.

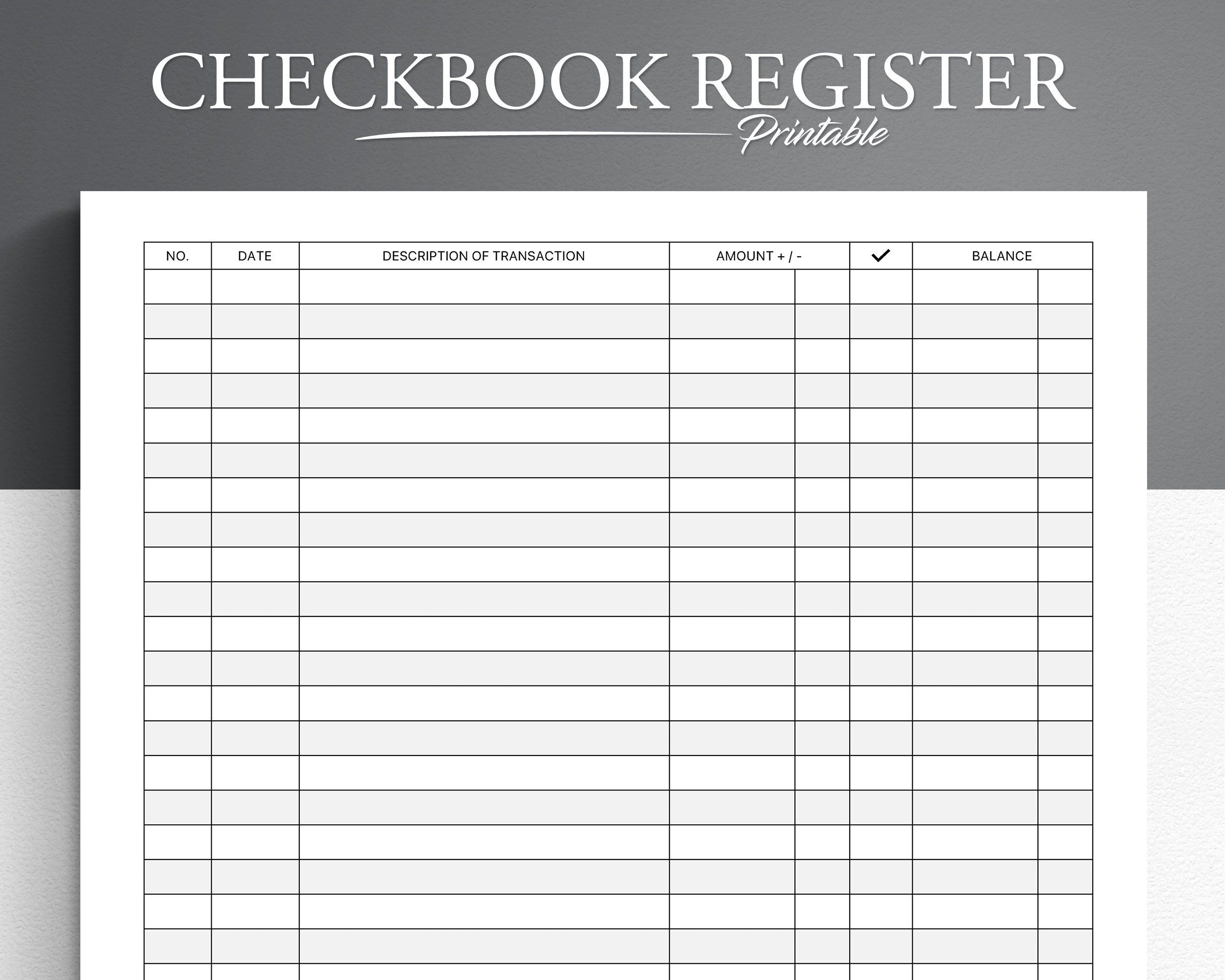

What essential fields should be included in a printable check register?

Essential fields in a printable check register typically include the date, check number, payee, amount, and balance. Additional fields, such as memo and category, can be added for enhanced tracking.

Can I customize a printable check register to fit my specific needs?

Yes, many printable check registers are customizable, allowing you to adjust the layout, fonts, and fields to suit your preferences and financial management style.

Where can I find printable check register templates?

Printable check register templates can be found online, in stationery stores, or through financial software programs. You can also create your own template using spreadsheet software or word processing programs.