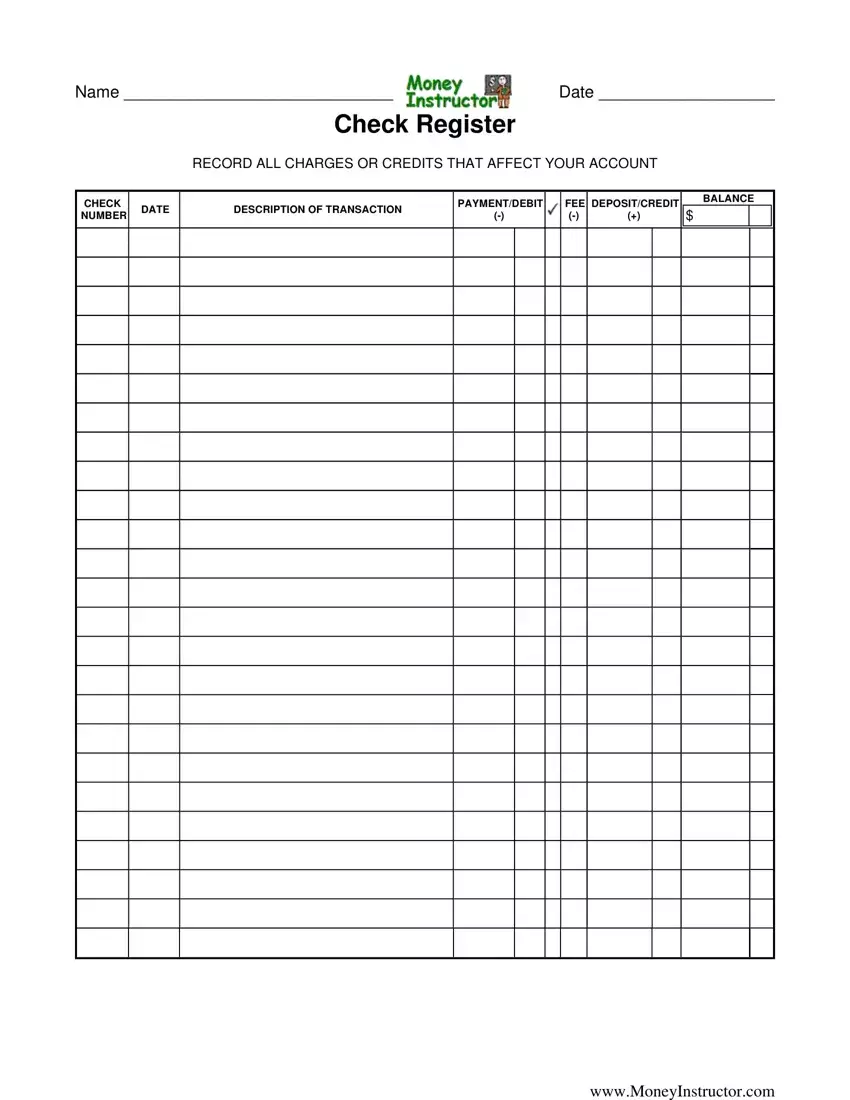

Master Your Finances with a Free Printable Check Register

In today’s digital age, it’s easy to rely solely on electronic transactions. However, a physical check register remains an invaluable tool for managing your finances effectively. A free printable check register offers a simple yet comprehensive way to track your income and expenses, ensuring you stay on top of your financial health.

Whether you’re a seasoned budgeter or just starting out, a check register can provide a clear snapshot of your financial situation. It allows you to monitor cash flow, identify spending patterns, and make informed decisions about your money.

Customization and Features

A free printable check register can be customized to suit your specific needs. You can add or remove columns, change the order of the columns, and even create your own custom categories. This flexibility allows you to track your finances in a way that works best for you.

In addition to basic tracking, many check registers also offer a variety of features that can help you manage your finances more effectively. These features can include:

Categories

Categorizing your transactions can help you track your spending and identify areas where you can save money. Most check registers allow you to create your own custom categories, so you can track the things that are most important to you.

Reconciliation

Reconciling your check register with your bank statement is a crucial step in ensuring that your finances are accurate. Many check registers offer reconciliation features that can make this process easier.

Tips for Optimizing Your Check Register

Here are a few tips for getting the most out of your check register:

* Use it regularly. The more often you use your check register, the more accurate it will be.

* Keep it organized. A well-organized check register will make it easier to track your finances.

* Review it regularly. Reviewing your check register regularly will help you identify any errors and make sure that your finances are on track.

4. Digital Alternatives

In this digital era, printable check registers have digital counterparts that offer a range of features and conveniences. These include digital budgeting apps and online banking tools.

Digital budgeting apps, such as Mint or YNAB (You Need a Budget), provide a comprehensive suite of features for managing your finances. They allow you to track your income, expenses, and budgets in one place, as well as set financial goals and monitor your progress. Many of these apps also offer features like automatic categorization of transactions, bill reminders, and investment tracking.

Advantages of Digital Budgeting Apps:

- Convenience: Easy to use and accessible from anywhere with an internet connection.

- Automation: Features like automatic categorization and bill reminders save time and effort.

- Comprehensive: Provides a holistic view of your financial situation, including budgets, goals, and investments.

Disadvantages of Digital Budgeting Apps:

- Cost: Some apps require a monthly or annual subscription fee.

- Data security: Concerns about the security of your financial data stored on third-party servers.

- Learning curve: May require some time to learn and master the features.

Online banking tools, offered by banks and credit unions, also provide features for managing your finances. These tools typically allow you to view your account balances, track transactions, and transfer funds. Some banks also offer budgeting tools within their online banking platforms.

Advantages of Online Banking Tools:

- Free: Typically offered as a free service by your bank or credit union.

- Integrated: Directly connected to your bank accounts, providing real-time access to your financial data.

- Secure: Banks and credit unions employ robust security measures to protect your financial information.

Disadvantages of Online Banking Tools:

- Limited features: May not offer as many features as dedicated budgeting apps.

- Inconvenience: Requires access to the internet and may not be as convenient as a mobile app.

- Bank-specific: Only allows you to manage accounts held at the specific bank or credit union.

Ultimately, the best solution for you will depend on your individual needs and preferences. If you value convenience, automation, and a comprehensive view of your finances, a digital budgeting app may be a good option. If you prefer a free and secure option that is directly connected to your bank accounts, online banking tools may be a better choice.

5. Practical Applications

A check register is a crucial tool for managing your finances effectively. It provides a comprehensive record of all your check transactions, allowing you to track your income and expenses with ease.

Here’s a step-by-step guide on how to use a free printable check register:

Recording Transactions

- Fill in the date of the transaction.

- Write the check number.

- Enter the name of the payee (the person or business you’re paying).

- Record the amount of the check.

- Indicate whether the transaction is a debit (money leaving your account) or a credit (money coming into your account).

Balancing Your Register

To ensure accuracy, it’s essential to balance your check register regularly. Here’s how:

- Add up all the debits in your register.

- Add up all the credits in your register.

- Subtract the total debits from the total credits.

- The result should match the balance in your bank statement.

Tips for Maintaining an Accurate Register

- Record transactions promptly to avoid missing any.

- Keep your check register in a safe and accessible place.

- Review your register regularly to identify any discrepancies or errors.

- Use a separate register for each bank account you have.

Real-Life Examples

Check registers can help you in numerous ways, such as:

- Tracking expenses: Monitor where your money is going and identify areas where you can cut back.

- Budgeting: Plan your spending and ensure you’re not overextending yourself.

- Identifying fraud: Spot unauthorized transactions and take prompt action to protect your funds.

- Tax preparation: Provide a comprehensive record of your financial transactions for tax purposes.

FAQ Corner

What are the benefits of using a free printable check register?

Free printable check registers offer numerous benefits, including easy accessibility, customization options, and a tangible record of your financial transactions.

How do I customize a free printable check register?

Most free printable check register templates allow for customization, enabling you to add categories, track specific expenses, or include notes for each transaction.

What are the key features of a check register?

Typical check registers include columns for recording the date, check number, payee, amount, balance, and notes.

How do I use a free printable check register?

Using a check register is straightforward: simply record each transaction as it occurs, including the date, amount, and a brief description.

What are some tips for maintaining an accurate check register?

To ensure accuracy, reconcile your check register regularly with your bank statements, keep receipts for reference, and review your register frequently for any errors or omissions.