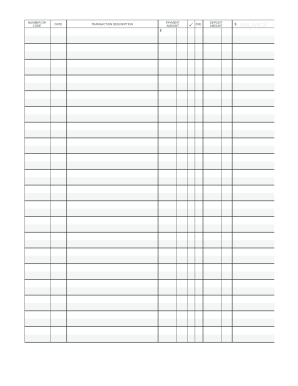

Printable Check Registers Free: Your Comprehensive Guide to Managing Finances

In the realm of personal finance, keeping track of your financial transactions is crucial for maintaining a healthy financial life. Printable check registers have emerged as an invaluable tool, offering a convenient and effective way to manage your finances. In this comprehensive guide, we’ll delve into the world of printable check registers, exploring their benefits, features, and best practices, empowering you to take control of your finances with ease.

Whether you’re an individual seeking to organize your personal expenses or a business owner looking to streamline your financial operations, printable check registers provide a versatile solution. With a wide range of customizable templates available, you can tailor your register to meet your specific needs and preferences, ensuring that every transaction is meticulously recorded and accounted for.

Features and Functions

Printable check registers offer an array of features to aid in financial management. These features assist in tracking income, expenses, and balances, making them invaluable tools for individuals and businesses.

One crucial feature is the ability to record transactions. Users can log each check written, along with its date, payee, amount, and category. This detailed record provides a clear picture of financial activity.

Transaction Categorization

Categorizing transactions is essential for understanding spending patterns. Check registers typically offer customizable categories, allowing users to group expenses by type, such as groceries, entertainment, or travel. This categorization simplifies budgeting and expense analysis.

Balance Tracking

Tracking balances is another key feature of check registers. They automatically update the account balance after each transaction, providing a real-time view of financial status. This feature helps prevent overdrafts and promotes responsible spending.

Income and Expense Summary

Many check registers include a summary section that provides an overview of income and expenses. This summary helps users quickly assess their financial situation and identify areas where adjustments can be made.

Check Numbering

Check registers assign unique numbers to each check written. This feature helps prevent duplicate payments and provides a clear audit trail for financial transactions.

Additional Features

Some check registers offer additional features, such as:

- Reconciliation tools to match bank statements

- Export capabilities to transfer data to spreadsheets or accounting software

- Memo fields for additional notes or descriptions

Benefits of Using

Using printable check registers offers a range of advantages compared to other methods of financial tracking. These registers provide a convenient and organised way to manage finances, aiding users in making informed financial decisions and achieving their financial goals.

Printable check registers allow users to:

Accurate Tracking

- Keep a detailed record of all financial transactions, including deposits, withdrawals, checks written, and other expenses.

- Easily track the flow of money and identify areas where spending can be optimised.

Budgeting

- Create and stick to a budget by allocating funds to different categories.

- Monitor expenses and ensure they align with the budget, preventing overspending.

Planning

- Plan for future financial goals, such as saving for a down payment on a house or a retirement fund.

- Track progress towards financial objectives and make adjustments as needed.

Peace of Mind

- Gain peace of mind knowing that financial records are organised and easily accessible.

- Reduce the risk of financial errors and identify any discrepancies promptly.

Tips for Effective Use

Maximizing the benefits of printable check registers demands a strategic approach. Embrace these tips to ensure accuracy and efficiency:

Maintain meticulous records: Document every transaction promptly and accurately. Neglecting even minor entries can compromise the integrity of your financial data.

Avoiding Common Pitfalls

- Prevent overdrafts by diligently tracking expenses and maintaining a buffer in your account.

- Reconcile regularly to detect discrepancies between your register and bank statements. Prompt resolution minimizes errors and prevents financial setbacks.

- Safeguard your register: Treat it as a confidential financial document and store it securely to prevent unauthorized access.

Online Resources

No need to rummage through drawers or spend a pretty penny on check registers. The internet’s got you covered with a plethora of free printable options. Check out these top-notch websites and online platforms:

Reputable Websites

- CheckRegister.com: A dedicated hub for all things check registers, offering a wide range of templates.

- Vertex42.com: Known for its customizable check registers, allowing you to tailor them to your specific needs.

- Check-Register-Template.com: A treasure trove of free check register templates in various formats.

Online Platforms

- Google Drive: Search for “printable check register” and you’ll be met with a plethora of templates to choose from.

- Dropbox: Similar to Google Drive, Dropbox offers a vast selection of check register templates.

- Microsoft Office Online: If you’re a Microsoft Office user, you can access a range of free check register templates within their online suite.

FAQs

What are the different types of printable check registers available?

Printable check registers come in various types, including personal check registers for individual use, business check registers designed for businesses of all sizes, and online check registers that offer digital convenience.

What are the key features to look for in a printable check register?

Essential features to consider include transaction date, payee, check number, amount, and a running balance. Advanced registers may offer additional features like income and expense tracking, budgeting tools, and customizable categories.

How can printable check registers help me manage my finances effectively?

Printable check registers provide a clear and organized record of your financial transactions, allowing you to track your income, expenses, and balances effortlessly. This enables you to identify spending patterns, control expenses, and make informed financial decisions.